Are you searching for some of the best digital payment gateway or different digital payment methods available in Pakistan? If yes, then you have landed on the correct page. This article will go through the best available digital payment gateway in Pakistan.

Digital Payment gateways are application software used to process payments and transmit the associated data to the acquiring bank. All those digital payment gateways serve as a go-between for customers, merchants, and related banks once a transaction has been completed online. These digital payment gateways have revolutionary encrypted technology of transactions which is faster and safer than traditional transactions.

Payment Gateways have had a substantial impact on the digitalization of Pakistan as it has made it possible for individuals, businesses, institutions, and governments for real-time online transactions. Cutting-edge technology makes it possible for digital payment gateways in Pakistan to make online transactions more affordable for people from all backgrounds.

Furthermore, all transactions are processed using secure payment methods, which assure that each transaction has been approved by the buyer and better data security and fraud detection capabilities.

So, now let’s take a closer look at the 6 Best Digital Payment Gateway or Methods Available in Pakistan.

What are the Factors to be Considered while Choosing a Payment Gateway?

You may wonder on what basis you can select the payment gateway to simplify your transactions. So, some of the factors you can consider while choosing a digital payment gateway in Pakistan are:

- Payment process that is simple to understand and follow.

- Low or Zero service charge as per agreement.

- 24/7 customer support.

- Free virtual cards (at least).

- Free biometric verifications.

- Adequate and complete Transactions.

- Free Debit Cards

6 Best Digital Payment Gateway Available in Pakistan

Now that you know about the basics of digital payment gateway, it’s time to start looking for an ideal one that fulfills your needs. So, here are the 6 best available digital payment gateway or methods in Pakistan. There are already telecom companies providing such facilities but a small level like JazzCash, EasyPaisa, UPaisa, PayMax, etc but they are limited and most of them are not made to receive or spend online, below are the best digital payment companies in Pakistan. We are also not talking about the banking applications (the applications that work after you open a bank account in Pakistan). We are talking about the apps or payment gateways you can make an account by sitting at home and receiving, sending and spending money online.

1. NayaPay

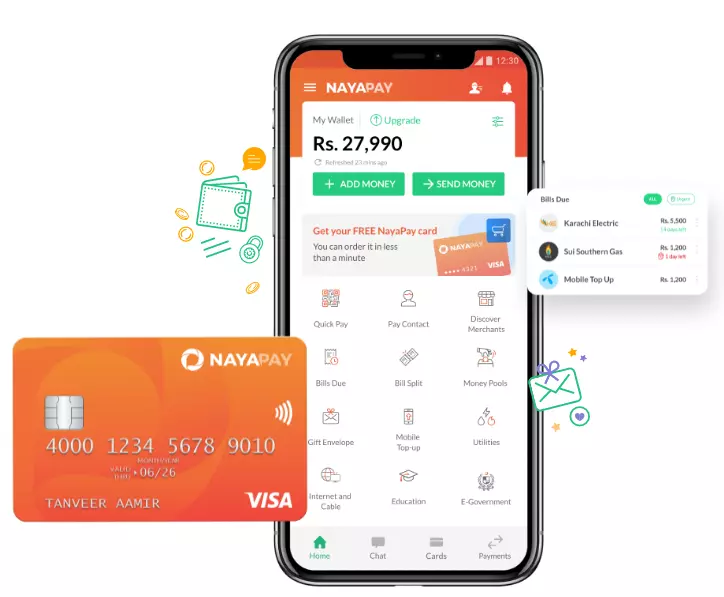

Nayapay is an EMI registered online payment gateway licensed under the State Bank of Pakistan (SBP). It offers users daily transactions in the form of e-money and banking services such as fund transfer, debit cards ( real and virtual), and other bill payment services.

With the Nayapay app, customers can quickly and easily pay their bills, send money to family and friends, and make purchases with their visa debit card. Merchants can receive payments, execute transactions and raise funds using their wallets. Nayapay has revealed that they are launching Arc Intro for small and medium-sized businesses to complete digital transactions. It will be a revolutionary platform and financial management solution for small firms.

Pros

- Free real and in-app virtual debit cards

- IBFT Transfers are free of charge.

- No yearly service charges.

- No waitlist.

- Control of debit cards within the app.

- Free Biometric verification at any Meezan Bank ATM.

Cons

- iOS is not supported.

2. SadaPay

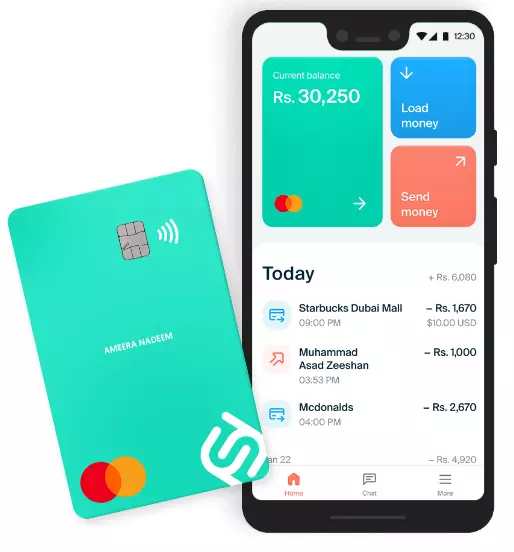

Sadapay is a secured digital payment gateway that was developed to make local and international payments in Pakistan more convenient. It is also registered as EMI under the license of SBP. Many financial services such as digital wallets, fund transfers, real/virtual debit cards, and utility payments are offered by Sadapay.

The Sadapay app is currently in the Beta phase, but its solutions have already appeared effective for the Freelancers and entrepreneurs in Pakistan. Soon, it will enable the users to take payments from 45 different international countries.

Pros

- Free Transactions and withdrawal.

- Enable Netflix, Amazon, and Scribd subscription purchases.

- Free debit cards (Real and Virtual).

- Lock cards if lost or stolen.

- Data encryption with the fraud detection system.

- 3 Free ATM cash withdrawals per month.

Cons

- No mobile Top-up feature.

- Refundable biometric verification charge.

- Referral system.

- Long waitlist.

3. Zindigi

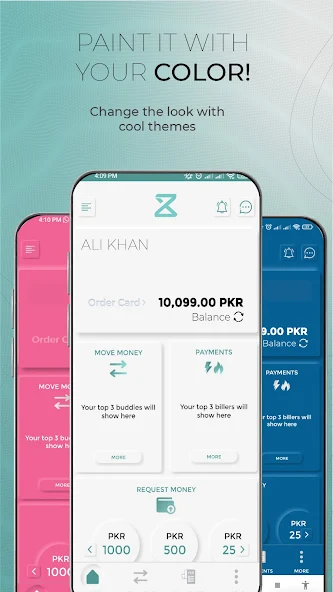

Zindigi is Pakistan’s first customizable digital payment gateway powered by JS Bank. The customers of Zindigi may access all financial services, including national and international payments, where the gateway also displays industry-first use cases, including digital stock and mutual fund investing.

Furthermore, the app offers a Z-store where you can shop with your MasterCard purchasing various items, tickets, subscriptions, and many more.

Pros

- Customization of widgets and themes.

- Availability of Personal e-commerce store ( Z-store).

- Compatible with both android and iOS.

- Virtual Debit Cards can be ordered.

- Door-step account upgrade and biometric verification.

- Excellent in-app experience.

Cons

- Requires CNIC number.

- Directs the user to contact a Zindigi agent to upgrade the service from basic to advanced.

- A charge is required for Debit card issuance.

4.QisstPay

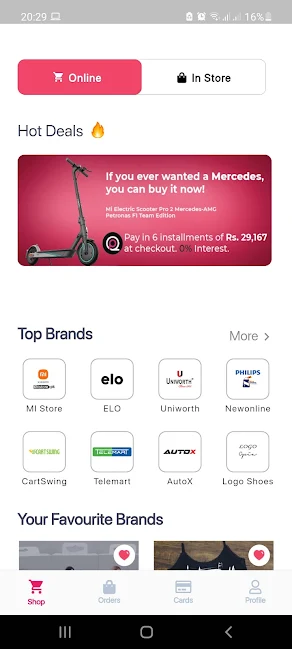

Qisstpay, Pakistan’s fastest growing purchase now, pay later firm, wants to revolutionize online and in-store deals. With Qisstpay, you can purchase without the weight of interest rates and the anxiety of handing over your personal information to someone else. You may shop more freely as a customer and join the network as a merchant to build your company.

Eventually, Qisstpay serves as a zero-margin, interest-free payment gateway designed to serve customers and retailers.

Pros

- 0 Mark-up and 0% interest.

- No CNIC is required.

- Safe and secured app.

Cons

- Bad in-app experience.

- Bad customer service.

5. Tag (tagme.pk)

Tag is also a virtual payment gateway available in Pakistan that provides users with an individual IBAN account number to receive money from anywhere in the world. The tag app offers easy money transfer payable to any Pakistani bank or digital wallet.

Tag is also registered as EMI under SBP, meeting service standards and requirements to safely execute financial service.

Pros

- Use AES encrypted technology for safety.

- Instant Card blocking facility for a lost or stolen card.

- No monthly fees.

- No hidden fees.

- Requires 0 minimum balance to start.

Cons

- Bad customer service.

- Lots of bugs in the app.

- Requires CNIC number.

- You may wait for a long time to get app access.

6. Pyypl

Don’t get confused by the name this one is not PayPal it is Pyypl (People). Pyypl is an international digital payment app and financial service provider incorporating blockchain technology into its core system and processes. It is the best alternative to a credit card system that is impeccable. You can download the Pyypl app free of cost from your app store.

You can receive a Mastercard for free with Pyypl, and you may use it to make transactions worldwide. With the Pyypl card, you can shop on Amazon, download music from Spotify, purchase a Netflix subscription, and many more.

Pros

- Free international Mastercard.

- Referral system.

- Control over your transactions.

- No bank account is required.

Cons

- Poor customer service.

- Frequent Transactional errors.

- Lots of bugs.

- Passport required to create account

Final Words

Paying for goods and services online or receiving money online may be a complicated and time-consuming process with various payment gateways or methods available. So, it would be best to have a simple, secure, flexible, and fast processing payment gateway to process your transactions. We did not mention two more payment methods Keenu & FonePay because we did not have much information on these two payment gateways nor we have tried them. Maybe in the future, we’ll write about them too.

Choosing the best digital payment gateways or methods in Pakistan may be difficult with all the pros and cons each has. However, after reading this article, we believe you got some ideas at least to find a prospective payment gateway suitable for you.

Spread the love