As the world turns into increasingly more digital, companies are looking for ways to streamline their charge processes. Digital fee gateways have emerged as a famous solution, permitting businesses to safely receive bills on line. With such a lot of options available, it could be overwhelming to select the quality one on your commercial enterprise.

That’s why we’ve compiled a listing of the top 10 digital charge gateways for 2023. These gateways provide various capabilities and blessings, from clean integration with famous e-trade structures to aggressive transaction costs. Whether you’re a small business owner or a big enterprise, there may be a payment gateway in this list that may meet your needs.

From the ubiquitous PayPal to the customizable Stripe, every price gateway on this list has some thing specific to offer. Some are better perfect for high-quantity transactions, even as others excel at global bills. By evaluating the features and prices of each gateway, you could make an knowledgeable selection approximately which one is right for your enterprise.

1. Security

When it comes to digital payment gateways, security is of the maximum importance. Customers need to recognize that their private and monetary facts is safe from prying eyes and capacity fraudsters. Here are two key elements of safety to don’t forget while selecting a payment gateway:

Encryption

Encryption is the manner of encoding information in a way that simplest authorized parties can get admission to it. Payment gateways use encryption to protect sensitive information, which includes credit score card numbers and personal info, from being intercepted by way of hackers or other malicious actors.

Some charge gateways use 128-bit SSL encryption, that is considered to be fantastically secure. Others, together with Braintree, use even more potent encryption strategies, including Advanced Encryption Standard (AES) 256-bit encryption. It’s important to pick out a charge gateway that makes use of robust encryption to ensure that purchaser facts is included.

Fraud Detection

Fraud detection is another crucial aspect of fee gateway protection. Payment gateways use diverse strategies to discover and prevent fraudulent transactions, along with:

- Address Verification System (AVS): This assessments the billing address provided with the aid of the client against the deal with on record with the credit card agency.

- Card Verification Value (CVV): This is the three-digit code at the back of a credit score card. Payment gateways can require clients to go into this code as an additional layer of protection.

- Transaction tracking: Payment gateways can display transactions for suspicious activity, which include multiple transactions from the same IP address or uncommon purchase styles.

Some charge gateways, along with Adyen, use device gaining knowledge of algorithms to locate and save you fraud. These algorithms can examine massive quantities of statistics to discover styles and anomalies which can indicate fraudulent hobby.

Also Read: 6 Best Digital Payment Gateway or Methods Available in Pakistan

2. User Experience

When it comes to virtual charge gateways, consumer experience is a vital aspect. A fee gateway that is tough to use or has terrible customer service can lead to frustration and lost income. Here we are able to explore the benefit of use and customer service of the pinnacle 10 virtual payment gateways.

Ease of Use

One of the maximum important elements in person enjoy is ease of use. The following table compares the convenience of use of the top 10 virtual price gateways:

| Payment Gateway | Ease of Use Rating |

|---|---|

| Braintree | 5/5 |

| Stripe | 4/5 |

| Square | 4/5 |

| PayPal | 4/5 |

| Authorize.net | 3/5 |

| 2Checkout | 3/5 |

| Worldpay | 3/5 |

| BlueSnap | 2/5 |

| Payline | 2/5 |

| Adyen | 2/5 |

As visible from the desk, Braintree is the easiest to apply with a rating of five/five. Stripe, Square, and PayPal additionally have excessive rankings for ease of use. On the opposite hand, BlueSnap, Payline, and Adyen have the bottom rankings for ease of use.

Customer Support

Another critical thing in user revel in is customer support. The following table compares the customer service of the pinnacle 10 digital fee gateways:

| Payment Gateway | Customer Support Rating |

|---|---|

| Braintree | 5/5 |

| Square | 4/5 |

| Authorize.net | 4/5 |

| Stripe | 3/5 |

| PayPal | 3/5 |

| 2Checkout | 3/5 |

| Worldpay | 3/5 |

| Payline | 2/5 |

| BlueSnap | 2/5 |

| Adyen | 2/5 |

As seen from the desk, Braintree has the exceptional customer support with a score of 5/five. Square and Authorize.Internet also have high ratings for customer support. Stripe, PayPal, 2Checkout, Worldpay, Payline, BlueSnap, and Adyen have lower ratings for customer support.

3. Integration

One of the most crucial factors to don’t forget when deciding on a digital payment gateway is how properly it integrates along with your present systems. A charge gateway with strong integration competencies can prevent money and time, reduce mistakes, and enhance the general client revel in.

API Support

API help is one of the maximum important integration capabilities to search for in a payment gateway. An API, or utility programming interface, is a hard and fast of protocols and gear that allows one of a kind software program applications to communicate with each different. A price gateway with a sturdy API can seamlessly combine together with your internet site or cell app, allowing you to accept payments without your customers ever leaving your platform.

When evaluating payment gateways, search for APIs which are properly-documented, clean to apply, and offer a huge range of customization alternatives. Some fee gateways also provide developer tools and sources, which include SDKs (software program development kits) and sample code, that will help you integrate their API more effortlessly.

Third-Party Integration

In addition to API help, many price gateways also offer integrations with 0.33-birthday party software program and gear. These integrations can help you streamline your payment processing workflows and improve your typical enterprise operations.

When evaluating fee gateways, look for ones that provide integrations with the software program and equipment you already use, inclusive of accounting software, inventory control structures, and CRM (purchaser dating control) software program. Some payment gateways also offer integrations with famous ecommerce platforms, together with Shopify and WooCommerce, making it clean to simply accept payments to your online shop.

Keep in mind that not all price gateways provide the same stage of integration competencies. Before deciding on a price gateway, ensure to assess its API assist and third-birthday party integrations to make sure that it’s going to meet your precise commercial enterprise needs.

4. Pricing

When choosing a digital fee gateway, it is crucial to remember the pricing structure. Different fee gateways have unique expenses and fees for their offerings. This phase will speak the transaction costs and month-to-month fees of the top 10 virtual payment gateways for 2023.

Transaction Fees

Transaction charges are charged by means of charge gateways for each transaction processed. These expenses can range depending at the price gateway, the type of transaction, and the quantity of the transaction. It’s important to take into account transaction prices while choosing a fee gateway, as they could add up speedy and devour into income.

Stripe, PayPal, and Braintree are some of the fee gateways that charge transaction costs. Stripe prices 2.9% + 30 cents according to transaction, PayPal expenses 2.9% + 30 cents in line with transaction, and Braintree expenses 2.Nine% + 30 cents per transaction. However, a few charge gateways, inclusive of Square and Helcim, offer flat-rate transaction prices, which can be beneficial for companies that method a high quantity of transactions.

Monthly Fees

Monthly prices are charged via fee gateways for get right of entry to to their services. These fees can vary depending at the charge gateway and the capabilities covered within the plan. It’s critical to do not forget monthly costs while choosing a price gateway, as they could add up through the years and effect profitability.

Stripe, PayPal, and Braintree are some of the payment gateways that rate month-to-month expenses. Stripe costs $20 in keeping with month for get entry to to its offerings, PayPal prices $30 according to month for get right of entry to to its services, and Braintree costs $49 in keeping with month for get entry to to its offerings. However, some fee gateways, which includes Square and Payline, do now not charge a month-to-month rate for get entry to to their offerings.

Overall, agencies should cautiously do not forget the transaction expenses and monthly prices of payment gateways whilst choosing a virtual fee solution. It’s crucial to discover a payment gateway that offers low priced costs and fees, while additionally providing the essential features and offerings to satisfy the desires of the commercial enterprise.

5. Compatibility

When deciding on a digital price gateway, it is important to don’t forget its compatibility together with your commercial enterprise wishes. This section will speak the supported currencies and nations of the top 10 virtual charge gateways.

Supported Currencies

Most digital payment gateways aid more than one currencies, however it is vital to ensure that the gateway supports the specific currencies that your commercial enterprise offers with.

| Payment Gateway | Supported Currencies |

|---|---|

| Braintree | Over 130 currencies |

| PayPal | Over 100 currencies |

| Stripe | Over 135 currencies |

| Authorize.net | USD, CAD, EUR, GBP, AUD, NZD, JPY, and more |

| Square | USD, CAD, AUD, GBP, and EUR |

Supported Countries

It’s additionally important to ensure that the digital fee gateway helps the nations in which your business operates.

- Braintree helps organizations in over forty five countries, consisting of the United States, UK, Canada, Australia, and many European international locations.

- PayPal helps organizations in over 2 hundred countries and areas, which include america, UK, Canada, Australia, and plenty of European and Asian countries.

- Stripe helps corporations in over 40 nations, which includes america, UK, Canada, Australia, and many European international locations.

- Authorize.Internet supports organizations within the US, Canada, UK, Europe, and Australia.

- Square helps organizations inside the US, Canada, UK, Australia, and Japan.

6. Customization

Customization is an crucial thing to do not forget while choosing a digital payment gateway. It permits organizations to tailor the price experience to their emblem and consumer desires. Here are a few customization alternatives to search for:

Branding Options

Some payment gateways offer branding options that permit organizations to personalize the look and feel of the payment web page to healthy their emblem. This can consist of adding a emblem, converting the coloration scheme, and including custom messaging. For instance, Stripe offers agencies the capability to absolutely personalize the look in their price web page with CSS.

Customizable Checkout Pages

Another essential customization alternative is the capability to create customizable checkout pages. These pages allow agencies to add or do away with fields from the price form, personalize the format, and add custom messaging. This can assist enhance the consumer enjoy and decrease cart abandonment rates. For example, PayPal offers groups the potential to create customizable checkout pages with their PayPal Checkout product.

Overall, customization is an essential attention when deciding on a virtual fee gateway. It allows organizations to create a continuing fee revel in that fits their brand and consumer desires.

When it comes to digital payment gateways, gaining access to facts and analytics may be vital for agencies to make knowledgeable choices. Many fee gateway carriers offer reporting and analytics tools to help groups reveal their transactions and gain insights into their clients’ behavior.

One such provider is BlueSnap. Their All-in-One Payment Orchestration Platform includes integrated price gateway analytics tools that provide a single, consolidated view of a commercial enterprise’s overall performance. Users can access their information via a rich reporting dashboard, cell app, or Reporting API. BlueSnap’s analytics equipment allow groups to investigate conversion quotes, view transaction history, and tune key overall performance indicators.

Another issuer with strong reporting and analytics skills is Payfirma. Their fee analytics software facilitates groups benefit insights into their sales overall performance, client conduct, and fee developments. With Payfirma, organizations can song transactions throughout more than one channels, consisting of online, in-save, and on mobile devices. They also can view specific reports on sales by using product, place, and customer.

Stripe is any other popular price gateway company that offers strong reporting and analytics gear. Their platform presents real-time insights right into a enterprise’s overall performance, consisting of transaction quantity, sales, and customer conduct. Stripe’s analytics equipment allow corporations to create custom reviews and dashboards to song key metrics and benefit insights into their clients’ behavior.

Overall, having access to reporting and analytics gear can be essential for businesses to make informed choices and optimize their fee processes. Providers like BlueSnap, Payfirma, and Stripe offer strong gear to assist organizations advantage insights into their performance and consumer conduct.

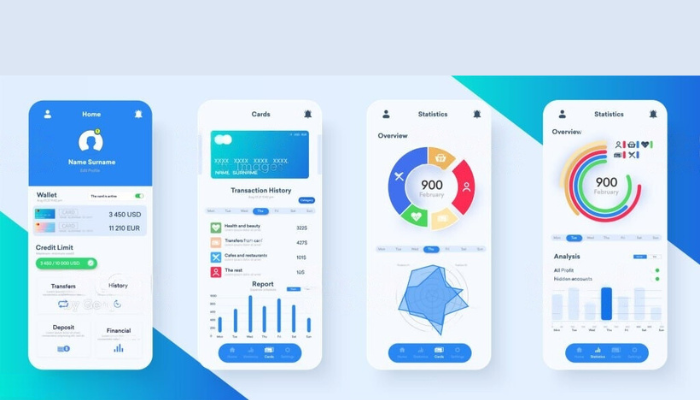

When it involves digital charge gateways, mobile help is a vital thing to consider. With the increasing use of smartphones and tablets, it’s vital for fee gateways to have cellular-pleasant interfaces and apps. Here are some of the fine virtual price gateways that offer tremendous cell aid:

- Braintree: Braintree’s cellular SDKs permit builders to combine cellular bills into their apps effortlessly. The SDKs assist each iOS and Android platforms, and they offer customizable UI components to suit the app’s design.

- Stripe: Stripe’s mobile SDKs allow builders to simply accept bills within their mobile apps. The SDKs guide each iOS and Android systems, and they provide customizable UI components to in shape the app’s layout.

- PayPal: PayPal’s mobile app allows users to send and get hold of payments on the cross. The app is to be had for both iOS and Android systems, and it gives a easy and person-friendly interface.

These charge gateways also offer cell-responsive web interfaces, because of this that customers can get entry to their debts and make bills from their cellular browsers with none issues. Overall, these price gateways provide wonderful mobile aid, making it smooth for users to make payments at the cross.

Conclusion

Choosing the proper digital fee gateway is important for any enterprise that wants to take delivery of online bills. With such a lot of alternatives available, it could be overwhelming to determine which payment gateway is excellent applicable on your commercial enterprise desires. However, after thorough research, we have compiled a listing of the pinnacle 10 digital payment gateways that offer the most reliable and steady price processing answers.

From our studies, we have determined that Stripe is the quality overall charge gateway because of its customization options, ease of use, and inexpensive pricing. PayPal is also a popular preference for many organizations due to its sizeable recognition and recognition for safety. For excessive-price transactions, Stax is a first-rate alternative, even as Square is ideal for outlets due to its person-pleasant interface and comprehensive features.

Other price gateways on our list, including Paytm for Business, Apple Pay for Merchants, and RazorPay, offer unique features and advantages that cater to unique business needs. It’s vital to assess every charge gateway’s pricing, safety capabilities, and compatibility along with your internet site or app earlier than creating a final choice.

Ultimately, the right payment gateway on your commercial enterprise will rely upon your precise requirements and budget. By selecting one of the fee gateways on our listing, you may make certain that your clients could make steady and hassle-loose bills on-line, leading to accelerated income and customer satisfaction.

Spread the love